Understanding Decoupling: How Markets and Economies Take Independent Paths

Imagine two dancers moving perfectly in sync, their steps mirroring each other flawlessly. Now, picture one dancer breaking away, moving to a rhythm of their own. This imagery encapsulates the essence of "decoupling" in finance. Decoupling occurs when two economic or financial entities, once closely linked, begin to diverge, often due to factors like policy shifts, changes in trade dynamics, or unexpected economic developments.

While the concept seems straightforward, its implications are profound, often signaling significant economic transformations and disruptions in traditional interdependencies. By delving into this phenomenon, we'll uncover its meaning, its importance, and how real-world examples shed light on its impact, reshaping the global financial landscape.

Decoupling in Finance

Decoupling essentially is the process in which two interrelated financial markets or economies start to move apart. Globally, economies and markets have hitherto trended together with the momentum set by trade partnerships, co-monetary policies, or other exogenous factors such as oil prices. However, decoupling implies a break in this synchronization.

Decoupling, in finance, is the state of less correlated performance among time- periods between stock markets, industries, or nations. An example of decoupling would be when emerging markets start growing by themselves, unlike the developed economies. This might be due to a stronger local demand, policy reforms, or diminishing dependence on foreign trade.

While the word often refers to a beneficial change, for example, when a country becomes economically independent, it can also indicate vulnerabilities. Thus, decoupling from reality would mean, for example, speculative bubbles driving stock prices too high is where the future instability could lie.

Why does Decoupling Happen?

Diverging Policies

One of the most common causes of decoupling is differences in fiscal or monetary policies. For example, if the U.S. Federal Reserve raises interest rates while European central banks maintain lower rates, the economic behavior of these regions can diverge. Investors may shift their money, weakening the correlation between the markets.

Local Economic Resilience

Certain countries or industries may grow due to domestic factors, regardless of global economic trends. A classic example is China’s rapid industrial growth in the 2000s. While developed economies grappled with recessions, China’s focus on infrastructure and manufacturing allowed it to thrive, marking a clear case of economic decoupling.

Global Crises and Recovery Rates

Crises like the 2008 financial meltdown can accelerate decoupling. Different regions recover at varying speeds based on their economic structures. For instance, while the U.S. stock market rebounded quickly after 2008, European markets lagged due to prolonged debt crises, highlighting decoupled recovery trajectories.

Trade Realignments

Trade wars and protectionist policies often push decoupling further. A prime example is the U.S.-China trade war, which led companies to diversify their supply chains, reducing reliance on China. This shift allowed economies in Southeast Asia to gain prominence, decoupling from their reliance on Chinese manufacturing.

Examples of Decoupling in Finance

1. Emerging Markets vs. Developed Economies

During the early 2000s, emerging markets like India and Brazil started showing strong growth despite sluggish performances in developed nations like the U.S. and Europe. The phenomenon was attributed to increasing domestic consumption, growing middle-class populations, and resource-driven economies. This decoupling showed that emerging economies could chart their growth paths independently of developed nations.

2. U.S. Stock Market vs. Global Markets

The U.S. stock market is often cited as a decoupled entity, particularly after the 2008 crisis. While other economies were slow to recover, U.S. companies capitalized on tech innovation and monetary stimulus, leading to an unprecedented bull market. Even during global slowdowns, U.S. markets often show resilience, signaling decoupling from broader financial trends.

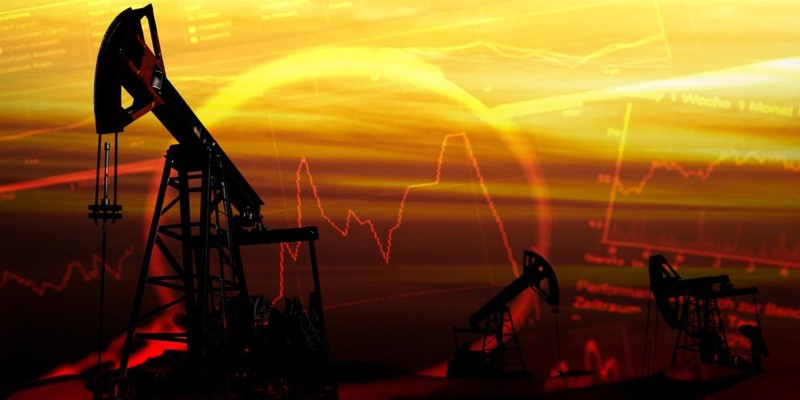

3. Energy Independence and Oil Markets

The shale oil revolution in the U.S. serves as another striking example. Historically, oil prices heavily influenced the global economy, with high prices dragging down energy-importing countries. However, as the U.S. achieved energy independence through shale oil production, its economic fortunes became less tied to volatile global oil prices.

4. China’s Economic Growth vs. Global Trade

China's rapid economic growth over the past few decades serves as a prime example of financial decoupling. Despite global economic slowdowns, such as during the 2008 financial crisis, China's economy continued to grow at impressive rates. This decoupling was fueled by its strong focus on infrastructure investment, domestic manufacturing, and a robust export-driven model, demonstrating its ability to maintain growth independent of global economic trends.

The Implications of Decoupling

Economic Independence vs. Vulnerability: Decoupling often highlights economic independence, allowing countries or industries to withstand global shocks. For instance, decoupled economies are better positioned during recessions or trade wars. However, independence can also mean isolation. For example, if an economy becomes too self-reliant, it risks missing opportunities in global trade or investments.

Market Volatility: When markets decouple, it can introduce new volatility. Investors accustomed to synchronized movements might struggle to predict trends. For instance, decoupled financial markets often lead to currency fluctuations as each economy pursues different growth paths.

Geopolitical Tensions: Trade realignments driven by decoupling often heighten geopolitical tensions. The U.S.-China rivalry exemplifies how decoupling strategies, like reducing reliance on each other, can fuel mistrust. These tensions can spill over into global markets, affecting investments and growth.

Long-Term Innovation: On a positive note, decoupling can spur innovation. When industries or economies pursue independent paths, they often seek competitive advantages through technology, efficiency, or unique trade practices. This dynamic competition benefits global consumers in the long run.

Conclusion

Decoupling in finance is a fascinating and complex phenomenon where the interconnectedness of economies or markets gives way to independent trajectories. While it signals resilience and self-reliance, it also introduces challenges like volatility, geopolitical tensions, and unpredictable growth patterns. Understanding this concept not only helps investors navigate a changing world but also equips policymakers to craft strategies that embrace independence while managing risks.